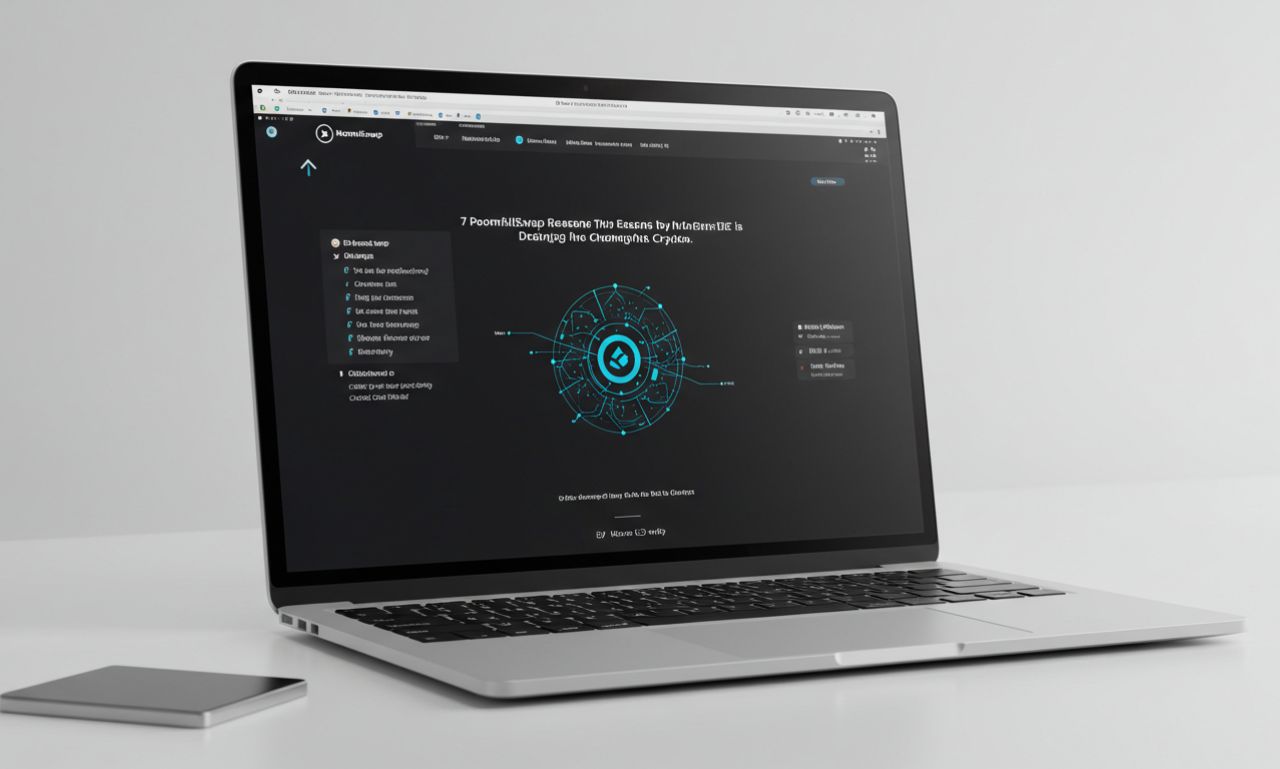

In the fast-moving world of decentralized finance (DeFi), new platforms emerge frequently. One of the latest names making waves is NaomiSwap (also called Naomi Swap). If you’re interested in crypto trading, liquidity protocols, or yield farming, you might wonder: what exactly is NaomiSwap, how does it work, and whether it’s safe or sustainable. In this article, I’ll take you through all the ins and outs — from the core features and mechanics to risks, comparisons, real use cases, and future outlook.

What is NaomiSwap?

NaomiSwap is a decentralized exchange (DEX) built for swapping digital assets in a peer-to-peer fashion without intermediaries. Users keep custody of their funds via wallet connections (e.g., MetaMask) rather than depositing them into centralized exchanges.

“It offers token swapping, liquidity pools, and yield farming; moreover, it aims for low transaction fees. In addition, it positions itself as a next-generation DEX, seamlessly combining the typical DeFi building blocks — such as automated market makers (AMM), staking, and LP rewards — with enhanced capabilities.”

Key Features of NaomiSwap

When evaluating a DeFi protocol like NaomiSwap, these are the main features to look at:

Token Swapping (DEX Functionality)

At its core, NaomiSwap lets you exchange one token for another directly on-chain. You pick the “from” and “to” tokens, and the smart contract handles the swap following the liquidity pool’s price curve.

Because it’s decentralized, there is no order book in the traditional sense, but an AMM model where prices adjust based on supply and demand within the pool.

NaomiSwap Liquidity Pools and Providers

Users can deposit pairs of tokens (e.g., Token A + Token B) into liquidity pools. In return, they receive LP tokens that represent their share of the pool. As trades occur, fees accrue, and LPs earn a portion of those fees proportional to their share.

This incentivizes liquidity, which is essential for slippage control and smooth swaps.

NaomiSwap Yield Farming and Staking

Beyond standard liquidity rewards, NaomiSwap supports yield farming: staking LP tokens (or other assets) to earn additional rewards (often in a native token). This is a common mechanism in DeFi to attract capital.

NaomiSwap Yield Farming and Staking

A key selling point of NaomiSwap is minimizing fees — whether gas costs or platform fees — via optimized smart contract coding.

By reducing friction, it makes small trades and micro-transactions more feasible.

NaomiSwap Wallet Control and Non-Custodial Access

Because NaomiSwap is a DEX, users never hand over custody of their assets to a central authority. The trades happen between your wallet and the protocol directly.

This model reduces the risk of centralized hacks or insolvency at the exchange level.

Cross-Chain / Multi-Chain Compatibility (Potential)

“Some descriptions suggest that NaomiSwap intends, or perhaps already has, cross-chain interoperability. This feature not only enables swapping between tokens on different blockchains but also, as a result, broadens its overall utility.”

If it supports layer-2 integrations or cross-chain bridges, it could improve throughput and lower fees further.

Governance / Token Utility (Speculated)

Future roadmap items include launching a native governance token, allowing community voting on upgrades or parameters.

Such tokens often also serve as rewards, governance incentives, or fee discounts.

How NaomiSwap Works (Step by Step)

To use NaomiSwap, here is a simplified journey:

-

Wallet Setup & Funding

First, you need a compatible wallet (e.g. MetaMask) with the tokens you plan to use. -

Connect Wallet to NaomiSwap

Visit the official NaomiSwap web interface and connect your wallet via Web3 integration. -

Select Swap Pair

Choose the token pair you intend to trade (e.g. ETH → USDC). The protocol reads the liquidity pool data and shows the estimated rate. -

Set Slippage & Confirm

Because DeFi is volatile, you set a slippage tolerance (e.g. 1% or 2%) to allow the swap to go through. Then you approve the transaction via your wallet. -

Swap Execution via Smart Contract

The smart contract executes the swap, pulling from pools and pushing to your wallet automatically. -

Add Liquidity / Stake

If you want to be a liquidity provider, you deposit equal value amounts of a token pair into the pool. You receive LP tokens. You might then stake or farm those LP tokens to earn additional rewards. -

Claim Rewards / Withdraw

You can periodically claim accrued fees or yield rewards and withdraw your liquidity (burn LP tokens) along with yields.

Advantages of Using NaomiSwap

Here are the main benefits users might enjoy:

-

Full custody & security

You keep control of your assets; trades never require handing over funds to a centralized party. -

Lower Fees & Efficiency

Optimized contracts and fewer intermediaries lead to reduced overhead. -

Passive Income Opportunities

As an LP or staker, you can earn fees and yield rewards. -

Transparency & Auditability

Every transaction is recorded on chain and can be verified publicly. -

Open Access / Permissionless

Virtually anyone with a wallet and supported tokens can participate. -

Innovation & Flexibility

With cross-chain plans and governance, there is potential for evolving functionality.

Risks and Challenges

As with all DeFi protocols, NaomiSwap is not without risk. Be aware of:

Impermanent Loss (IL)

Liquidity providers can lose value relative to holding assets outright, when asset prices diverge.

Smart Contract Vulnerabilities

Even audited contracts might have bugs or exploits. A flaw could result in fund loss.

Market Volatility & Slippage

Rapid price swings can cause executed rates to differ significantly, especially for large trades.

Liquidity & Depth Constraints

Low liquidity in certain pools can lead to high price impact or even failed swaps.

Regulatory Uncertainty

Governments may treat DeFi protocols differently; regulatory changes could impose restrictions or new requirements.

Tokenomics and Sustainability

If a protocol relies heavily on reward tokens, inflation or poor tokenomics might damage long-term sustainability.

Use Cases & Real Scenarios

-

Trader swapping small tokens

Small holders can swap efficiently thanks to low fees. -

Liquidity provision & yield farming

Users provide pairs like ETH/USDT, earn fees, and farm tokens. -

Cross-chain bridging

In the future, swaps may bridge across chains. -

Governance participation

Token holders may vote on changes, pool additions, or upgrades. -

Community incentives

Referral or bonus programs could help grow the user base.

Security & Trust Considerations in NaomiSwapv

Users should check:

-

Smart contract audits.

-

Transparency of the team and roadmap.

-

Bug bounties or insurance.

-

Community size and developer activity.

Without these, risks remain significant.

How to Get Started Safely

-

Start with small amounts.

-

Use a secure wallet.

-

Double-check slippage settings.

-

Don’t overcommit to one pool.

-

Stay updated via official announcements.

-

Diversify across protocols.

Future Outlook & Roadmap

The success of NaomiSwap depends on:

-

Launching a governance token.

-

Expanding to more chains and layer-2 solutions.

-

Adding advanced features like lending or derivatives.

-

Building a strong community.

-

Strategic partnerships and integrations.

If it delivers, NaomiSwap could become a serious player in the DEX ecosystem.

FAQs

What blockchain does NaomiSwap run on?

It may support multiple blockchains; moreover, there is potential for expansion into cross-chain swaps, which could significantly increase its flexibility and user appeal.

Is NaomiSwap safe to use?

It carries typical DeFi risks. Users should approach carefully and verify contracts.

How do I earn by using NaomiSwap?

Through liquidity provision, staking LP tokens, and possibly governance rewards.

How does NaomiSwap differ from Uniswap or SushiSwap?

It emphasizes low fees, cross-chain potential, and a newer user experience.

What are the risks for liquidity providers?

Impermanent loss, volatility, and smart contract vulnerabilities are major risks.

Will NaomiSwap issue a governance token?

Yes, a native governance token is expected as part of its roadmap.

Conclusion

Yes, a native governance token is expected as part of its roadmap. Moreover, it is anticipated to strengthen community involvement; in addition, it will likely play a crucial role in voting, rewards, and long-term sustainability. Still, as with any DeFi protocol, risks like impermanent loss, smart contract vulnerabilities, and market volatility must be carefully weighed.